These simple ways to avoid debt can help you avoid charging big ticket items and making impulsive spending decisions.

Being in debt can have a significant impact on our lives, causing stress, anxiety, and limiting our ability to reach important financial goals. However, avoiding debt is not impossible, and there are steps we can take to maintain financial stability and avoid the pitfalls of debt.

4 Benefits of Being Debt Free

More money each month: Debt is a drag on our financial health — not only the interest we pay for things we bought in the past, but the outpouring of money it takes each month to make more than the minimum payment and eliminate the debt.

Less stress and more energy: The Bible describes debt as a millstone around the neck, and I can remember the heavy feeling I had when my credit card balances were over $12,000. Being debt free, on the other hand, is a wonderful feeling!

Better relationships: Money is the #1 thing couples fight about, and being deep in debt just adds more conflict, pressure and stress. When you’re on the same page about finances and debt, life is much sweeter.

A brighter future: When all of our income is earmarked for credit card payments and debt, we can’t plan vacations, save to be prepared for unexpected expenses, or make home improvements because we’re spending all our time and resources paying off those old balances. Getting out of debt opens up so many new possibilities!

Our family has been on a mission to pay off debt.

In addition to retiring my credit card and using cash or a debit card to pay for everything now, we’re officially $600 away from being debt-free. Seven months ago, that number was $2964.00.

With freedom in sight, I’ve been thinking about the situations, events and temptations that have taken me down the slippery slope of credit card debt in the past.

I don’t profess to have all the solutions, but here are four steps I’ve taken to avoid new credit card debt:

1. Create an Emergency Savings Account

Twenty-four hours before my fiftieth birthday, our main sewer line broke in a big and dramatic fashion. One day I was in my 40s and life was fine, and the next day I was middle-aged, our front yard was torn up, and a man in coveralls was presenting me with a grubby $7500 bill for a sewer line.

Let me say that again: I did not celebrate the advent of my golden years with a $7500 first-class trip on the Orient Express, I purchased a sewer line. Naturally I didn’t have $7500 set aside for such things, so I charged the sewer line on my Visa and spent the next three years paying it off.

My friends, learn from my experience and vow to live your life differently.

If you’re familiar with Dave Ramsey’s Financial Peace University, Baby Step #1 of his seven steps to financial freedom is to set up a $1000 emergency fund.

Suze Orman recommends having three to six months of living expenses set aside. My suggestion? At the minimum, set aside the full amount of your family’s annual out-of-pocket liability on your health insurance policy.

Oh, and you may wish to accumulate $7500 or so and tuck it away in an account in case you ever need a new sewer line.

The “bottom” line? Having an emergency fund will help you avoid using a credit card for emergencies. By the way, have you had your sewer line scoped recently? Most physicians recommend doing this procedure annually.

2. Set Up a Freedom Account

If you’re like many of us, each year brings a few zinger bills — those large chunks of money due for items like taxes, car insurance premiums, accountants, HOA fees and the like. Those big expenses can derail a budget quickly. Wouldn’t it be nice to already have the money set aside? You can, Kemosabe.

Simply make a little spreadsheet, figure out the amounts and dates due, add the totals together and divide by 12. Create a separate savings account—which I like to call the Freedom Account because it has such a nice, hopeful ring to it—and contribute regularly. The more we can all regulate our expenses and smooth out those budgetary ups and downs, the easier it is to stick to goals and stay on track.

3. Open a Vacation Account

When my daughter studied abroad in Denmark, she invited me to come stay with her at the end of her term. The timing happened to coincide wonderfully with a friend’s offer to visit her beach apartment in Spain. The one teensy weensy minor detail to these wonderful invitations was a sorry lack of cash, so I charged the whole shebang on my already-beleaguered Visa card (even though I hadn’t yet paid off my sparkling new sewer line). It’s so easy to swipe that card, but as many of us know it can take years and years and years of scraping by to reduce the balance. Paying off credit card balances (and the accompanying interest) for things that happened years ago is not fun.

I am of the view that vacations are necessities, though, so we must plan accordingly. Now we have a dedicated savings account just for vacations, and you can, too. Like me, you may wish to set up your vacation account at a different bank from the one where you keep your primary account—perhaps one that’s clear across town—so you’re less tempted to dip into it. Credit unions are especially accommodating about setting up multiple accounts without fees for savers.

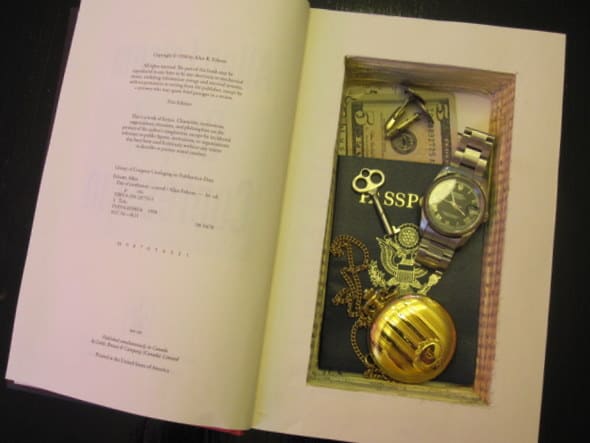

4. Keep Some Cash Around

Cash is a handy thing to have on hand, as I have discovered countless times.

It’s useful for paying a tow truck driver late at night (don’t ask), an unplanned babysitter, and the arborist who was working at the neighbor’s house and agreed to trim our leggy locust tree for $75 cash.

Even small amounts can reduce stress, like keeping a few dollars worth of quarters and other change in the car’s glove compartment for unexpected parking meters or tolls. Some people tuck a $20 or $50 in a hidden place in their wallet for emergencies, an idea I admire endlessly even though I was not blessed with the gift of being able to keep cash in a wallet.

At the other end of the spectrum, a friend of a friend recently discovered a hundred hundred-dollar bills (that’s right, a cool ten grand) that her dad had tucked away with his will to pay for his funeral expenses.

Of course, if you keep some cash around there is always the risk that something will happen to it. Feelin’ crafty? You could make a cool, secret book safe to stash small amounts of cash.

Fireproof safes and safety deposit boxes are probably better choices for significant amounts of cash, not that I’ve successfully accumulated a large pile myself. But it could happen.

How about you? What situations, emergencies or temptations caused you unplanned debt in the past, and how do you avoid them now? (Read “How Broke Have You Been?” for some funny anecdotes about the pitfalls of the uber-frugal lifestyle.)

Do you have multiple savings accounts? How do you handle those big, chunky annual bills? What do you think about keeping cash around? I’d love to hear your thoughts, stories and strategies, so drop a comment below.

My hope is that we can all enjoy the financial freedom and peace that comes from not carrying around a heavy burden of debt.

About Eliza Cross

Eliza Cross is the author of 17 books, including Small Bites and 101 Things To Do With Bacon. She shares ideas to simplify cooking, gardening, time and money. She is also the owner of Cross Media, Inc. and founder of the BENSA Bacon Lovers Society.

Great advice. It all seems very do-able, and your explanations for why we should take these steps make complete sense to me. Thank you.

PS – I got my sparkling new sewer line several years before turning 50. So now I’m wondering what surprise I’ll get for my 50th in just a couple months…

Dear Kim,

You have my utmost sympathy. You spend all that money on a new sewer line, and you can’t even show it off to anyone! If we were neighbors, I’d come over regularly to pay compliments on yours. Here’s hoping your 50th is full of HAPPY surprises.

xo

This is a great list. I love having my emergency fund because it gives me BIG peace of mind!

You are so right. We need to add more funds to ours before I’ll really experience that feeling of being fairly prepared, but we’re getting there. Thanks, Michelle.

Oh my… so far the sewer line is still intact, though at some point here the house will need to be re-plumbed since it’s still got the original galvanized pipe instead of copper.

I’m always impressed with people who have these separate savings accounts and who save for specific things. I just try to live on as little as possible and the rest goes to savings. At this point I could probably go for at least 10 years without bringing in another cent – assuming no horrible giant expenses. Of course, it’s not like I have a ton of money, I just have very low expenses!

Anyhow, at this point in my life my income comes from ads on my various web pages. I work with two different ad companies, one of which pays significantly better than the other. Both pay me monthly through automatic deposit, so I have it set up so that the well paying one goes into my checking account and I try to live entirely off of that money.

Income from the other ad agency goes directly into a savings account at a different bank. When times are lean I sometimes need to transfer money to meet my regular expenses, but generally the stuff in the savings account is just used for major stuff like the new furnace a few years back, or a big treat like my new bicycle last fall.

When the savings account starts to get big I take a hunk out and put it into some sort of a CD or other account where it’s harder to access with the goal of never touching that money again until “someday.” It takes about 3-4 business days to do a bank to bank online transfer to move money from the savings to my checking account, so that prevents me from tapping into it on a very regular basis. Plus the fact that I never really see that money makes it psychologically much easier not to have the urge to spend it!

I had a similar but different system set up back when I still had a “real job” – automatically putting a certain amount into savings each month and transferring money to CDs and timed accounts once the amount in my savings account reached a certain threshold. So far I’ve only ever cashed in one of these CDs – and I did it last year when it was about to roll over at a ridiculously low rate I decided that it would be better to use that money to mostly pay off my mortgage… now I’ve only got a few more months to go!

I do use credit cards regularly, but I have them set up to pay off the full balance automatically each month. I have reminders set up so I can go check the amounts and transfer money if need be each month, but I rarely need to.

Anyhow, that’s my “system” such as it is! Hope you are enjoying your shiney new sewer line! 🙂

Wow, I’m completely in awe of your financial system. Thank you for sharing how you make a simple lifestyle work for you: low expenses, income-producing websites, a clever arrangement of checking, savings and investment accounts, and money set aside for big expenses – not to mention, you’re about to pay off your mortgage! What a testament to your many years of disciplined savings and your careful cultivation of a lifestyle that fits your values. I admire you on so many levels!

xo

I think it’s so important to keep a huge emergency account. It gives one great peace of mind. Without an emergency account there are always surprise expenses that can push you mentally and financially over the edge.

I always listen to your financial advice, Barbara! 🙂 Thanks for the reminder that a well-funded emergency account is of paramount importance.

I especially like the vacation fund. I agree that vacations are necessities and I really like to travel. No need to make it more expensive by going into debt over, though.

Here’s wishing you happy travels, Greg! Right now we have enough in our vacation fund to pay for an overnight in Nebraska, but I’m aiming for a week-long family trip to Hawaii.

I try to save a certain percent of each months income which works well for me. I also eliminated credit cards and shop with cash only as it’s harder for me to fork over the real money than to swipe the debit card. I also have an allowance for spending each week which keeps me focused on necessities. One way I see people getting into trouble is with overdraft protection on their bank accounts.

That’s a good point, Lois. It’s great that you’ve made such good decisions and designed your life in such a way that you don’t pay for anything you can’t afford. I love reading about how you do it on your blog. Readers, be sure to check out Lois’s blog, Living Simply Free.

I just borrowed the Dave Ramsey book “The Total Money Makeover” and read the entire book to my husband while on a road trip. We are now totally inspired to pay off $21,000 of debt (not including mortgage) and plan to have it paid by Christmas 2014! Then we can make double payments on our mortgage and have it paid off in 6 or 7 years. I plan to buy every young person I know a copy of this book.

I love that book, Jena, and I doubly love your idea to buy it for young people! Wishing you great success and diligence as you pay off your debt in the coming months. I’m pulling for you!

xo

I’m only 24 years old right now and I’m trying to teach myself now how to avoid debt in the future. I have already consumed over $60,000 in school loan debt. Therefore, if I can avoid in other debt, that would be great.

Thank you for this article because it definitely has helped me as far as teaching me how setting a few money-saving goals for myself. I definitely will be opening up a new emergency savings account.

I have a septic system, so I didn’t have to replace the main sewer line, but I did have to get the main line to my septic roto rooted, although it was only a few hundred bucks, so wayyy cheaper then your experience. It just so happened it crapped out on me (pun intended) on a weekend that I had about 15 people staying over. This meant I couldn’t flush or stuff would seep up in my basement. I had to send people to the Giant Grocery store down the street to use the bathroom. Not good for a party.